For all the transactions processed, an invoice is raised and shows up on your Cashfree Merchant Dashboard on/after the 5th of the next month. You will be notified of the invoice generation on your registered email address provided to us.

Note: If your account has availed Free Trial credits for the billing period and you don't have any charges or deductions, or if your account is on the surcharge model, an invoice will not be raised for you, since you have not been directly charged for the transactions.

Please follow the below steps to download the invoice:

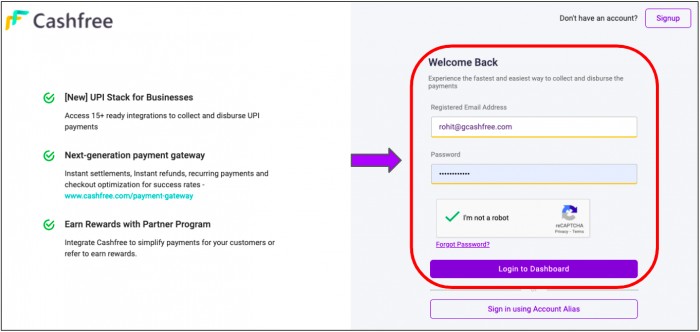

1. ‘Login’ to your Cashfree account

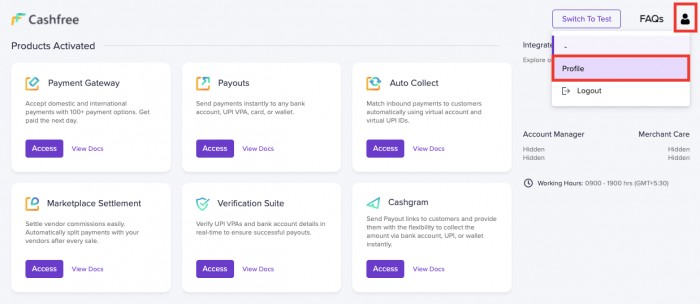

2. On the Home page, click the Profile/User icon on the top right corner and click ‘Profile’ from the menu.

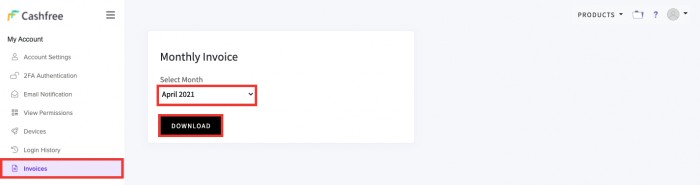

3. On the Profile page, click ‘Invoices’, select the month-year combination from the dropdown, and click on ‘Download’

4. A new tab will open where your generated invoice(s) will be shown and you can download them

Cashfree Payments India Private Limited comes under the purview of e-Invoicing under GST, and it is mandatory for us to capture all required details of the merchants correctly to generate e-Invoices. Please check the invoice to ensure that your tax details are correct.

If you want to claim Input Tax Credits, we request you to send us your latest GST registration details and the GST certificate at the earliest. Please ignore this if you have already registered your details with us and details are present on the generated invoice.